The latest research into seafood shopping experiences identifies opportunities to make seafood buying simpler for consumers.

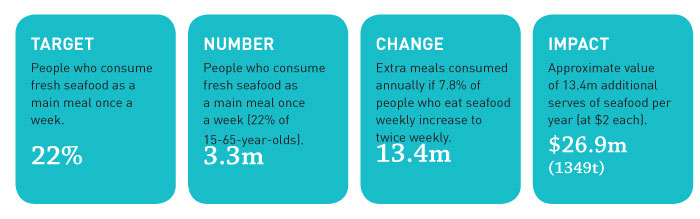

How addressing the issue could grow the market – for example determining the freshness

How addressing the issue could grow the market – for example determining the freshnessThe difficulties in determining how fresh seafood is and how long it will last in the refrigerator have been identified as key barriers for consumers when it comes to buying seafood – even among those who eat it on a regular basis.

This is one of the findings to come from the FRDC’s latest market research, conducted in mid 2016 and summarised in the report, Unpacking the consumer seafood experience.

Peter Horvat, the manager of communications, marketing and trade at FRDC, says the research is aimed at more than fine-tuning marketing messages. It has been valuable in identifying issues that prevent consumers buying seafood – issues that could be addressed by research, development and education.

“We know why people like seafood. What we don’t know is why they don’t, what stops them from buying it and what just annoys them,” he says. “We have been focusing on the issues of consumer preferences and seafood marketing so that we can better link and integrate it with the FRDC’s research and development program – to ultimately deliver on FRDC’s priority of improving productivity and profitability.”

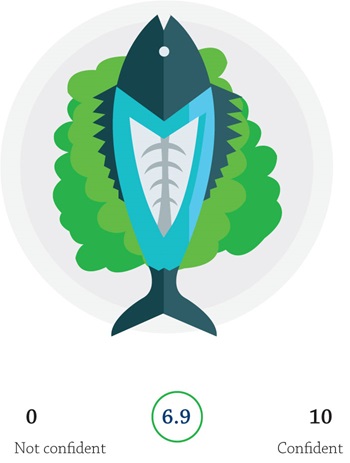

Level of confidence in buying seafood

Level of confidence in buying seafoodThe research consisted of an online survey of 2000 adult Australian grocery buyers undertaken from 21 June to 2 July, 2016. It collected information on a wide range of consumer seafood buying, cooking and eating experiences to document the problems people have with seafood and identify where the opportunities for improvement lie.

The survey targeted three key experiences in depth – purchasing, preparation/cooking and eating.

It found that 95 per cent of respondents ate some seafood at least once a year, with 91 per cent eating fresh seafood. However, 36 per cent ate seafood infrequently (no more than once every two months), or not at all. Almost one in three households also have at least one person who won’t or can’t eat seafood, which affects the overall incentive for buying seafood.

More than half of consumers (57 per cent) said they bought their seafood from supermarkets as part of a regular shop, with 17 per cent buying from seafood markets, 9 per cent from seafood shops and 7 per cent from other markets. This finding is likely to reflect the wide range of tinned and frozen seafood available from supermarkets.

However, for many people seafood remains an occasion-based experience; there are fewer who include it as part of the weekly food plan.

And while there is a common perception that seafood is expensive, 42 per cent of respondents found its value to be on par with other forms of meat, while one-third indicated seafood was better value.

“It’s clear that price is not as big an issue for consumers as previously thought,” says Peter Horvat.

New opportunities

Table 1 (below) summarises seven of the issues consumers identified as reasons they did not buy seafood more often, and cross-references them against consumption frequency to identify the impact addressing a particular issue could have.

Barriers include determining freshness, making it value for money through improved shelf life, the smell and mess involved, frozen and tinned products and confidence in product knowledge.

“We have undertaken some basic analysis of the results to highlight key opportunities. It seems clear from the results that if we can address some of the reasons why people don’t eat seafood, we could increase consumption,” says Peter Horvat.

Take, for example, the issue of determining freshness, which all consumers reported as a deterrent, regardless of how often they ate fish.

If it was possible to make this easier to determine and even a third of those who already eat fish for a main meal once a week increased their intake to two main meals a week, that could increase seafood sales by up to $27 million a year.

Potential solutions could come from better information, new technology, or new products and packaging.

“The report highlights key issues such as this, where FRDC and industry could target investment in order to have a tangible impact. Ultimately, if we are successful this will equate to an improvement in the bottom line for the industry (more sales, less waste) and improved consumer satisfaction and purchases.”

This kind of research demonstrates the need for a strong understanding of the end consumer and can provide insight into the areas that require investment, and it provides a mechanism for evaluating the success of improved marketing and other initiatives.

Peter Horvat says Unpacking the consumer seafood experience also contains a wealth of information for producers, retailers and marketers to use as a base for improving direct consumer marketing and for developing their product offerings.

| Consumption frequency | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Barrier to consumption | All Consumers | More than once a week | Once a week | Once a fortnight | Once a month | Once every two months | Once every three months | Once every four months | Once every six months | Once every year | Less often |

| This represents % of all fresh seafood meals | 100% | 12% | 22% | 16% | 20% | 8% | 5% | 4% | 5% | 2% | 5% |

| They consumer % of all fresh seafood meals | 100% | 39% | 37% | 14% | 8% | 2% | 1% | 0.4% | 0.3% | 0.1% | 0.1% |

| Determining the freshness | 71% | 76% | 72% | 71% | 70% | 77% | 68% | 69% | 67% | 71% | 65% |

| Making it a value for money buy certainty of fridge life | 61% | 65% | 60% | 57% | 59% | 66% | 64% | 59% | 64% | 67% | 57% |

| The smell-before, during and after | 48% | 43% | 42% | 44% | 51% | 49% | 52% | 58% | 60% | 58% | 57% |

| What"s the difference: fresh vs frozen vs tinned | 48% | 56% | 49% | 47% | 47% | 51% | 46% | 36% | 45% | 49% | 36% |

| Build my confidence in what I can and might buy and where I buy it from | 46% | 57% | 49% | 43% | 42% | 47% | 40% | 38% | 45% | 49% | 42% |

| Taking the uncertainty away: selecting, preparing seafood- making it easier and faster to prepare | 41% | 40% | 38% | 38% | 40% | 43% | 35% | 46% | 49% | 48% | |

| The mess – during and after | 33% | 32% | 30% | 30% | 33% | 29% | 40% | 49% | 40% | 44% | 34% |

The purchasing experience

Supermarket 57%

Seafood market 17%

Seafood shop 9%

Market 7%

Seafood wholesaler 3%

Caught it myself 3%

All the docks 1%

Other 3%

Five key things that are important to people when they purchase seafood:

1. Knowing where the seafood was caught.

2. Knowing how long it"s been in store.

3. Knowing if the seafood is fresh or has been frozen.

4. Whether the seafood was caught in Australia or overseas.

5. Knowing how long the seafood will last at home.